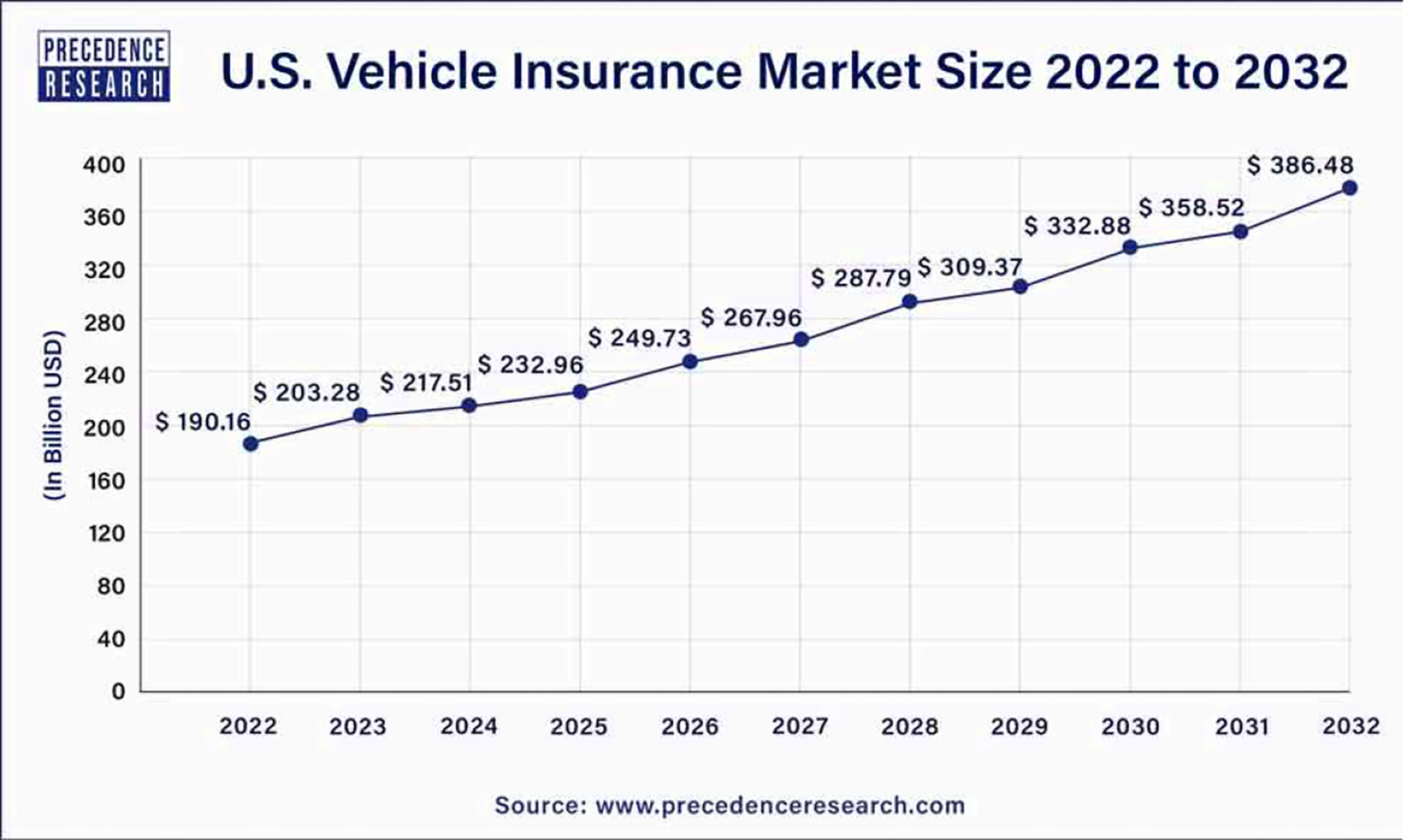

Thanks to technology, the insurance market is undergoing a major makeover and changing consumer expectations. In 2023, the global insurance market was valued at $5.2 trillion. And this number is expected to increase to $7.5 trillion by 2030, at a CAGR of 5.6%.

But do you know what has resulted in this surge? The rising demand for personalized insurance solutions and the convenience that mobile apps bring to the table. A survey revealed that 70% of consumers prefer managing their insurance policies through mobile apps instead of traditional methods.

One standout example of the best insurance mobile app is GEICO. This app perfectly shows how technology can simplify the insurance experience. Users can easily file claims, access digital ID cards, and even chat with a virtual assistant—all at their fingertips! How great is that?

Want to build an app like GEICO? You are at the right place. In this blog, we will discuss:

- Features to include in the GEICO-clone app

- How to build an app like GEICO?

- Legal compliance of insurance apps

- Cost considerations in developing an insurance app

- Insurance mobile apps similar to GEICO

- Future trends in insurance apps

Let’s get started!

Features to Include in the GEICO-Clone App

When creating a GEICO-clone app, integrate features that can enhance the user experience and simplify insurance management. You can think about what users really want: whether it's a seamless way to access their policies, file claims, or get support.

Here are some essential features that will make your app stand out and keep users engaged:

User Panel Features

1. Notification Center

Notify users via push notifications about important news, like policy modifications, renewal reminders, and discounts.

2. Vehicle Maintenance

Send users maintenance and servicing reminders to help them keep their cars in good working order.

3. Digital ID Cards

Allow users to download and store digital identification cards for insurance to make it easy to prove insurance during a traffic accident or roadside stop.

4. Roadside Support Services

Include a roadside support service feature so users can request help with things like gasoline delivery and towing. Add real-time tracking as well.

5. User Registration

Users must easily create an account with personal information, car details, and insurance preferences. Also, make it simple for users to edit their profiles.

6. Purchase of Policy and Renewal

Allow customers to peruse and buy auto insurance coverage straight from the app. Remind them to promptly renew their policies.

7. Quote Generation

Provide a quote generator where customers can enter their personal and vehicle details to get fast and customized insurance rates.

8. Claim Submission

The app should allow users to quickly and conveniently report accidents, file claims, and provide images and documents.

9. Document Upload

Allow users to upload documents like driver’s licenses, vehicle registrations, and other relevant papers straight from their phones.

10. Payment Integration

Users can set up automatic payments for convenience and integrate secure payment gateways. Put strong security measures in place to protect user information and transactions.

11. Chat Support

Use a live chat system or messaging to connect customers with support workers for questions and assistance.

12. Claims Tracking

Inform users of the development and status of their insurance claims. It will provide them with transparency and assurance of peace of mind throughout the claims procedure.

13. Discounts and Rewards

Implement a system that allows users to earn discounts or prizes based on their loyalty and driving behaviors.

Admin Panel Features

1. Policy Management

Easily create and manage new insurance policies, including establishing coverage options and prices.

2. Document Verification

Allow admin staff to verify uploaded documents for authenticity and adherence to insurance policies.

3. Discounts and Rewards

Discount and incentive schemes must be flexible enough for administrators to make changes in response to user behavior and promotions.

4. Access Control and Security

Assign different access levels for admin roles and use strict security measures to protect user’s private information.

5. Integrations

To enhance policy issuance and claim processing, integrate the app with third-party systems like financial institutions, government databases, and third-party data providers.

6. Compliance and Reporting

Verify that your insurance app adheres to all legal and regulatory requirements. It must have the ability to produce reports for audits.

7. System Monitoring

Keep an eye on the development of your insurance app, fix any bugs, and guarantee system availability.

8. Dashboard and Workflow Management

Administrators should have a customizable dashboard that displays important metrics to make their jobs easier.

9. User Management

Along with monitoring and approving new registrations, admins must be able to manage user accounts and profiles.

10. Clain Processing

Claims management software should be available to the admins so they can examine, approve, and process claims.

11. Payment Monitoring

Keep track of premium payments, past due accounts, and payment histories so that you can respond quickly if there is a non-payment.

12. Communication Tools

Use a messaging system to let administrators and users communicate with each other. It enables them to reply to questions, handle issues, or offer assistance.

13. Push Notifications

Administrators can send customized push alerts to users on policy updates and significant announcements.

How to Build an App Like GEICO?

Now that you know the features that can be included in the GEICO-clone app, let’s discuss how to build one. The car insurance app development process requires you to have a strategic approach to combine advanced technology, user-centric design, and in-depth knowledge of the insurance sector.

Follow the steps below for a better vehicle insurance app development journey:

1. Understand Market Trends and User Needs

Start by getting to know your audience. What do they want from an insurance app? You can:

- Conduct Surveys: Ask potential users about their expectations.

- Analyze Competitors: Look at what other insurance apps are doing well and where they fall short.

- Stay Updated on Trends: Keep an eye on new technologies and features that could enhance the user experience.

2. Define Core Features

Figure out the essential features that you want your insurance app to have. Regardless of your app’s simplicity or complexity, consider including:

- User-Friendly Interface: Make navigation simple and intuitive.

- Claims Processing: This allows users to submit claims easily and track their status in real-time.

- Policy Management: Let users access their policy details and digital ID cards effortlessly.

- Customer Support: Integrate chatbots or live chat for quick assistance.

- Payment Integration: Offer secure payment options for premiums and claims.

3. Use Advanced Technologies

To make your app stand out, consider using innovative technologies:

- AI-Powered Features: Use AI for personalized recommendations and efficient claims processing.

- Blockchain for Security: Enhance data protection with blockchain technology, ensuring transparency and security.

- API Integrations: Connect with third-party services for added functionality, like geolocation or payment processing.

4. Choose the Right Tech Stack

Selecting the right technology is crucial for performance:

- Cross-Platform Development: Use frameworks like React Native or Flutter to build apps for both iOS and Android. This will reduce development time and cost while helping you reach a broader audience.

- Backend Solutions: Opt for robust backend technologies like Node.js or Django for smooth data management.

- APIs for Better Functionality: Include third-party APIs for features like payment processing and geolocation services.

5. Create a Prototype

Before diving into full development, create a prototype. This helps you:

- Validate your ideas with real user feedback.

- Identify potential issues early on.

- Lastly, align stakeholders on the app’s design and functionalities.

6. Design and Development Process

Once you have a prototype, move into design and development:

- UI/UX Design: Focus on creating an engaging, user-friendly interface. For this, you can use tools like Figma or Adobe XD.

- Agile Development: Use agile practices to adapt based on feedback.

- Testing: Conduct thorough testing, like unit testing, integration testing, and user testing, to ensure everything works smoothly.

7. Launch and Continuous Improvement

After development, launch your app! But remember, this is just the beginning:

- Gather Feedback: Collect users' feedback post-launch of the app to find areas for improvement.

- Regular Updates: Keep the app functioning with regular updates based on user needs.

- Marketing Strategies: Promote your app through social media and SEO by creating effective marketing strategies.

Legal Compliance of Insurance Apps

Creating an insurance app like GEICO isn’t just about adding innovative features and a sleek design. You also need to ensure that the app adheres to necessary legal compliance. Below are the key areas to consider:

1. Understand Regulatory Frameworks

First things first, familiarize yourself with the regulatory landscape. Insurance apps must comply with various federal, state, and local regulations. However, these regulations vary based on the geographical area where the app operates.

- Federal Regulations: Insurance companies in the USA regulate at the state level, but federal laws like the Health Insurance Portability and Accountability Act (HIPAA) and the Gramm-Leach-Bliley Act (GLBA) may apply, especially if your app collects personal information.

- State Regulations: Each state has its insurance department that sets specific rules for selling and servicing insurance products. Be mindful of the laws of the state where you plan to operate.

2. Data Protection and Privacy Laws

In today’s digital age, data privacy is a hot topic—and for good reason. Users want to know their information is safe. Here’s what you need to consider:

- General Data Protection Regulation (GDPR): If your app reaches users in Europe, you’ll need to comply with GDPR, which requires clear consent for data collection and strong safeguards for personal data.

- California Consumer Privacy Act (CCPA): In California, consumers have rights over their personal information. Your app should be transparent about what data you collect and give users options to control their information.

3. Insurance-Specific Requirements

Besides general regulations, there are specific industry standards that you must adhere to during insurance mobile app development:

- Licensing: If your app helps users buy insurance, you might need a license as an insurance broker. Check the requirements in each state where your app operates.

- Consumer Protection: Laws are in place to ensure consumers are treated fairly. This means being upfront about policy details, pricing, and coverage options.

4. Automated Compliance Solutions

Let’s face it—keeping track of all these regulations can be overwhelming. Thankfully, technology can help:

- Compliance Management Software: Tools like Complinity can keep you updated on legal changes and help manage your compliance status without drowning in paperwork.

- Certificate of Insurance Tracking: Use systems that automatically track necessary compliance documents, so you don’t have to worry about missing something crucial.

5. Stay Vigilant with Audits

Compliance isn’t a one-and-done deal; it requires ongoing attention:

- Regular Audits: Schedule routine checks to ensure your app remains compliant with all applicable laws. This will help catch any potential issues before they become problems.

- Keep Learning: The regulatory landscape is always changing. Stay informed by subscribing to industry news or using compliance tools that alert you to new developments.

Cost Considerations in Developing an Insurance App

Building an insurance app like GEICO comes with its fair share of budgeting. Understanding what to expect financially can help you set a realistic budget without breaking the bank. Here’s a breakdown of the key cost considerations to keep in mind:

Vehicle insurance app development costs can greatly vary. On average, you might spend anywhere from $35,000 to $300,000. Here’s a quick breakdown:

- Basic Apps: If you want a simple app with essential features, expect to spend around $20,000 to $50,000.

- Moderate Complexity: For more advanced features and integrations, you need to stretch to about $50,000 to $150,000.

- Highly Complex Apps: Lastly, if you’re aiming for advanced functionalities like AI chatbots or extensive analytics, be prepared to pay $150,000 and more.

What Drives These Costs?

Several factors can influence how much you need to spend on your app:

- Features and Functionality: The more features you want, the higher the development cost will be. Why? Because each feature adds complexity and requires development time.

- Design Matters: A great user experience is key to keeping users engaged. Investing in visually stunning designs can range from $5,000 to $30,000, but it’s worth it.

- Tech Choices: Your choice—whether you want native apps (separate builds for iOS and Android) or a cross-platform solution—affects both your budget and timeline. Native apps usually require more resources.

What about Team Structure and Location?

The team you choose can significantly impact your costs:

- In-house vs. Freelancers: Building an in-house team gives you control but can be pricey. Freelancers may offer a more budget-friendly option (around $45,000 to $80,000), while local agencies often charge more (around $140,000) due to their overhead.

- Outsourcing: If you’re open to outsourcing development from regions with lower labor costs, you might find prices starting as low as $30,000, which can save you a lot without sacrificing quality.

Don’t Forget Ongoing Costs

Once your app is up and running, you need to consider these additional expenses:

- Maintenance: Your app will need regular updates and maintenance to perform well. This typically adds about 15% to 20% of the initial development cost each year.

- Feature Upgrades: As users provide feedback and your business grows, you’ll want to add new features or improve existing ones. Budgeting for these enhancements is crucial for keeping your app relevant.

Insurance Mobile Apps Similar to GEICO

When developing an insurance app like GEICO, you must look at other successful apps in the market. These apps not only inspire but also highlight features that users love. Here are some popular apps similar to GEICO.

1. State Farm

It is a household name in the insurance world, known for its wide range of coverage options and a user-friendly app.

Key features:

- Claims Management

- Instant Quotes

- Agent Communication

2. Progressive

This app stands out for its competitive pricing and innovative tools, making it a strong contender against GEICO.

Key features:

- Name Your Price Tool

- Snapshot Program

- 24/7 Roadside Assistance

3. Allstate

A robust mobile app that enhances customer experience and simplifies insurance management.

- Easy Policy Management

- Drivewise Program

- Virtual Assistant

4. Esurance

The app appeals to tech-savvy users with its modern approach to insurance.

Key features:

- Quick Claims Process

- Policy Comparison Tools

- Mobile ID Cards

Future Trends in Insurance Apps

Since you want to develop a GEICO-clone app, you must also keep an eye on the future trends in insurance apps. Here are some exciting trends to watch for in insurance apps:

1. Integration of AI and Automation

Artificial intelligence (AI) and automation are set to change the game in the insurance world. Here’s how they’re making waves:

- Streamlined Claims Processing: AI can automate claims processing, reducing the time and effort required to handle claims.

- Personalized Policies: With AI analyzing data from various sources, insurance apps can offer custom policies that fit individual needs.

- Smart Chatbots: AI-powered chatbots are heavily used to provide automated assistance, handle policy inquiries, and process claims effectively.

2. Rise of Embedded Insurance

Embedded insurance is gaining attention, and it’s all about convenience. Here’s what it means for your app:

- Seamless Integration: Embedded financing streamlines the insurance sales process by providing coverage after the insured has provided the required information.

- Custom Coverage: By using data from other services, insurers can offer personalized plans based on actual usage. For example, if you frequently travel for work, you might receive a plan that covers rental cars.

- Lower Costs: This model can help reduce customer acquisition costs since insurers can partner with businesses to reach potential customers more effectively.

3. Increased Use of IoT and Telematics

The IoT and telematics are becoming essential tools for insurers. Here’s how they’re changing the insurance apps:

- Real-Time Insights: IoT devices can provide real-time data about user behavior—like driving patterns or home security, helping insurers assess risk more accurately.

- Usage-Based Insurance: With telematics, drivers can pay premiums based on how safely they drive. If you’re a cautious driver, you could save money.

- Proactive Risk Management: Insurers can use data from these devices to step in before a problem occurs. For example, if your car’s sensors detect a mechanical issue, your insurance provider could alert you before it leads to an accident.

How Can Protonshub Help You Develop an App Like GEICO?

Want to develop an insurance app like GEICO? Protonshub Technologies is here to help make that dream a reality for you.

Being the best mobile app development company, our team specializes in creating user-friendly. We work closely with the clients to ensure that the development is done as per your vision.

Unlike other companies, our support doesn’t stop at launch. We provide ongoing maintenance and updates to keep your app running smoothly and relevant in a fast-paced market.

Let’s create something amazing together!

Frequently Asked Questions

Focus on user-friendly design and security features to enhance the overall experience. You can include user registration, policy management, claims processing, payment integration, and a customer support chat function.

The development process can take anywhere from 3 to 6 months. This includes planning, design, development, testing, and deployment phases.

You can consider subscription models, in-app purchases for premium features, or partnerships with service providers for referral commissions to monetize your insurance app.

Regular updates keep apps functioning. You should aim for at least quarterly updates to fix bugs, enhance features, and keep up with industry changes.

To maintain the security of your app, you must implement strong encryption for data storage and transmission. You can also use secure APIs and comply with regulations like GDPR or CCPA.

Contact Us

Contact Us

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.png)