-

About Us

CMMI Level 5 Certified

Where You Deserve the Positive Outcomes!

Positivity, Purpose, and Perseverance are what make the Protonshub the most sought-after and a leading name in Custom Software Development across the globe. We specialize in Advisory Services, Application Development & Maintenance, Business Process Outsourcing, Enterprise Consulting, End-to-End Technology Services, and Digital Strategy to help make the business world exceptional.

-

Services

Speak with an expert today!

We’d love to resolve your queries with personalized assistance.

Let’s Connect - Solution

-

Industry

-

430

+Apps Developed

-

680

+Websites Designed

-

175

+Happy Clients

-

220

+Team Strength

-

-

Resources

Jun 27, 2022

Microservices The Shining Star Of New Age IT InfrastructureChanging design patterns and race to substantiate the modern design and delivery approach Microservices architecture has been the face of the shift and has been a potential front runner in mainstream design process and methodology

Read MoreJun 21, 2022

Multi Tenant Architecture!As per a report by Gartner, by the end of 2022, the cloud services industry is expected to grow exponentially by 40%, and the market size of the cloud services industry will be approximately 3X the overall growth of IT services.

Read MoreJun 10, 2022

Trending UI/UX DesignThe business value of design aesthetics is no more a question to be asked. In this era of digital transformation, user experience is what drives a software product’s success, whether B2B or B2C. Hence, it has become critical for businesses to understand the significance of seamless and unique UI/UX design services for their product.

Read MoreFeb 20, 2025

HIPAA Compliant App Development: A Detailed Guide for 2025Learn key steps for HIPAA-compliant app development to ensure secure healthcare solutions. Discover best practices for data security and compliance.

Read MoreFeb 18, 2025

How to Create Medical Billing SoftwareGet a step-by-step guide to developing medical billing software. Learn key features, cost, and required tech stack for the development process.

Read MoreFeb 12, 2025

How to Make an App like AstrotalkWant to create an astrology app like AstroTalk? Learn about key features, development costs, future trends, development process, and more.

Read MoreFeb 05, 2025

How Biometrics Make Payments Easy and SafeLearn how biometrics are changing payment systems by offering a safer and convenient way to complete transactions. Contact us for more information.

Read MoreJan 31, 2025

14 E-commerce Customer Retention Strategies That WorkIs your e-commerce business struggling with customer retention? Try these 14 effective strategies that can transform your approach!

Read MoreJan 27, 2025

11 Essential Features Every Successful E-commerce Website Must HaveIncrease your e-commerce potential. Learn about the 11 crucial features that every successful online store should include for optimal performance.

Read MoreJan 24, 2025

Healthcare CRM: What You Need to Know About Costs, Features, and BenefitsAre you curious to learn about Healthcare CRM? If yes, read this blog to know the costs, features, and more that can help your healthcare practice grow.

Read MoreJan 21, 2025

AI in Energy Management Systems: Driving Operational EfficiencyRead this blog to learn how AI technologies are optimizing energy management systems to improve operational efficiency and cut costs.

Read MoreJan 18, 2025

Your Guide to Designing a Renewable Energy WebsiteLearn how to create an effective renewable energy website with easy tips on design, content, and user engagement.

Read MoreJan 14, 2025

Website Migration Guide: Pre and Post-ChecklistGet ready for a seamless website migration. Follow our pre and post-checklist to ensure everything runs smoothly before and after the move.

Read MoreJan 09, 2025

Application Management Services: A Simple GuideLearn the basics of Application Management Services and how they can improve your IT processes. A simple guide for better application management.

Read MoreJan 06, 2025

Guide to EHR Systems: Features, Benefits, and PricingDiscover everything you need to know about EHR systems. This guide covers key features, benefits for healthcare providers, and pricing options.

Read MoreJan 01, 2025

How to Build a DeFi App in 2025: A Complete GuideReady to create a DeFi app? Our complete guide for 2025 covers everything from key features, development steps, and challenges to help you create a successful DeFi app.

Read MoreDec 25, 2024

How to Set Up an Effective Dropshipping Business on Shopify in 2025Ready to start your dropshipping journey? This guide covers everything you need to know about launching a profitable dropshipping Shopify store.

Read MoreDec 18, 2024

Why You Should Hire a Dedicated Remote Developer in 2025Explore the top 9 reasons to hire dedicated remote developers in 2025, from cost savings to niche expertise and clear communication.

Read MoreDec 11, 2024

End-to-End E-commerce Solutions: Why It’s Crucial for Your Business GrowthRead this blog to find out why complete e-commerce solutions are important for your business growth and how they can help you improve your operations.

Read MoreDec 04, 2024

Choosing the Right Technology Stack for Your E-commerce BusinessWant to build a successful e-commerce site? This blog will help you understand how to choose the perfect tech stack for your business!

Read MoreNov 28, 2024

Step-by-Step Guide to Developing a Multiplayer Poker App Like A3 PokerLearn how to develop a multiplayer poker app like A3 Poker with our easy step-by-step guide. Build your app today and engage players worldwide!

Read MoreNov 21, 2024

How to Develop an App Like UEFA GamingLearn how to build an app similar to UEFA Gaming! Discover essential tips and tricks to bring your gaming ideas to life. Contact us to know more.

Read MoreNov 13, 2024

The Role of AI in Quick Commerce App Development for Personalized User ExperienceLearn how AI is transforming Q-commerce app development to create a more personalized shopping experience for users. Contact us to know more.

Read MoreNov 06, 2024

Why Quick Commerce App Development is Essential for Retail Businesses TodayThinking about app development? Find out how Q-commerce can transform your retail business by speeding up deliveries. Contact us for more details.

Read MoreOct 30, 2024

Top Features to Include in a Quick Commerce App for Maximum User EngagementFind out the best features to include in your quick commerce app. Make shopping fun and keep users coming back for more! Contact us for more details.

Read MoreOct 24, 2024

How to Build an App Like GrabReady to build a unique food delivery app? Learn how to create a Grab-like app with essential features and expert services. Contact us today.

Read MoreOct 17, 2024

Chatbot vs. Live Support: Which Is Better for Your Business?Explore the differences between chatbots and live support to determine which solution best fits your business needs. Discover the pros, cons, and more.

Read MoreOct 10, 2024

Why Every Business Needs a Custom Chatbot: A Comprehensive GuideBoost your business with a custom chatbot designed for your unique needs. Explore the benefits that drive customer satisfaction and growth.

Read MoreOct 03, 2024

How to Develop an App Like GEICODiscover essential steps and features to develop a successful insurance app like GEICO. Learn about user experience and innovative functionalities.

Read MoreSep 26, 2024

Top 10 Use Cases of AI-Powered Chatbots in HealthcareLearn about the top 10 use cases of AI chatbots that enhance patient satisfaction, reduce wait times, and optimize healthcare services.

Read MoreSep 19, 2024

How Custom Chatbots are Revolutionizing Patient Care in the Healthcare IndustryUncover the power of custom chatbots in healthcare. From appointment scheduling to symptom assessment, see how they enhance patient experiences and care.

Read MoreSep 13, 2024

How to Develop a Food Delivery App Like ZeptoUncover the secrets to building a successful grocery delivery app like Zepto, including must-have features and steps for quick commerce.

Read MoreSep 09, 2024

How to Develop a Food Delivery App Like SkipTheDishesDiscover the essential steps to develop a food delivery app like SkipTheDishes. Learn about key features and steps to ensure your app stands out.

Read MoreSep 03, 2024

Building a WordPress E-commerce Store: A Complete GuideTransform your WordPress site into a thriving e-commerce store! Follow our complete guide for expert tips on setup, customization, and boosting sales.

Read MoreAug 30, 2024

How to Optimize WordPress Website for Performance and SpeedIs your WordPress site slow? Find out how to optimize performance and speed with our comprehensive guide on best practices and tips.

Read MoreAug 26, 2024

How to Develop a Mobile App Like ZalandoDiscover how to develop a successful mobile app like Zalando. Learn essential strategies, features, and steps to bring your fashion app idea to life!

Read MoreAug 19, 2024

Shopify vs. WooCommerce: Which Platform is Right for Your Business?Explore the pros and cons of Shopify and WooCommerce. Make an informed decision to elevate your e-commerce strategy and maximize profits.

Read MoreAug 12, 2024

How to Set Up Your Shopify Store: A Step-by-Step GuideReady to start your online business? This guide walks you through every step of setting up your Shopify store, from design to launch. Start selling today!

Read MoreAug 06, 2024

Optimizing Your Shopify Store for SEO: Best PracticesElevate your Shopify store's search engine rankings with these SEO best practices. Discover tips on canonical tags, site speed, and more to drive traffic.

Read MoreJul 31, 2024

How to Build an NFT Marketplace Like OpenSeaLearn how to create an NFT marketplace similar to OpenSea. Discover essential features, technologies, and strategies to launch your platform successfully.

Read MoreJul 26, 2024

How to Build a Hotel Booking App Like OYOWant to build a hotel booking app like OYO? This guide covers everything from market overview and features to strategies for a successful app.

Read MoreJul 23, 2024

How to Build a Restaurant Booking App Like OpenTableLearn how to create an OpenTable clone app that streamlines reservations and dining experiences. Discover key features, strategies, and more.

Read MoreJul 16, 2024

How to Build an App Like NetmedsUnlock the secrets to developing a Netmeds clone app. Explore the must-have features, costs, market stats, revenue models, and more.

Read MoreJul 12, 2024

How to Build an App Like SheinWhether you're a startup or an established business, our guide will walk you through the process of creating an e-commerce app similar to Shein.

Read MoreJul 08, 2024

Blockchain Development Guide: Everything You Need to Know in 2024Explore the latest trends shaping blockchain development in 2024. This guide covers everything you need to know to stay ahead in this evolving field.

Read MoreJul 03, 2024

How Blockchain Technology Can Revolutionize the Fintech IndustryGet ready to discover how blockchain is transforming the fintech industry by increasing security, reducing costs, and enabling faster transactions.

Read MoreJun 28, 2024

Understanding Generative AI: Can it Create the Next Killer Mobile App?Dive into the world of generative AI and discover how it can be leveraged to create innovative, user-centric mobile apps that redefine the industry.

Read MoreJun 24, 2024

Leveraging AI and Machine Learning for Enhanced Stock Insights in Your AppLearn the right way to harness the power of AI and ML to transform your app's stock analysis features, providing users with a competitive edge.

Read MoreJun 19, 2024

Real-Time Data Integration: Challenges and Solutions for Stock Market AppsLearn how to overcome data integration challenges in stock market apps by using real-time data integration solutions for a better user experience.

Read MoreJun 14, 2024

How to Build a Crypto Exchange Platform Like BinanceDevelop a crypto exchange platform similar to Binance with this detailed guide. Learn about the key features, advanced features, cost, steps, and more.

Read MoreJun 10, 2024

How to Build an App Like RobinhoodFrom key features, steps, and costs to the best monetization strategies, learn everything about building an app like Robinhood.

Read MoreJun 05, 2024

How to Develop a Food Delivery App Like MenulogLearn how to create a food delivery app like Menulog. This guide covers the key features, steps, challenges, and costs of developing a Menulog-clone app.

Read MoreJun 03, 2024

How to Build a Shopping App Like Costco?Are you interested in building a shopping app like Costco? This guide discusses the steps, key features, costs, and more to develop an app like Costco.

Read MoreMay 29, 2024

Why Hire Dedicated Developers Instead of Freelancers?Unlike freelancers, dedicated developers prefer quality over quantity and increase efficiency. This is not it. Read this blog to learn more about the benefits.

Read MoreMay 24, 2024

How Much Does It Cost to Hire a Software Developer in India?Want to hire a software developer in India but don’t know how much it will cost? Read this guide to learn everything to make an informed decision.

Read MoreMay 20, 2024

How to Make an Online Shopping App Like AmazonWant to create an online shopping app like Amazon? Read this guide that covers everything you need to know, from features to best practices.

Read MoreMay 14, 2024

How to Develop an App Like GrowwAre you planning to develop a stock trading app like Groww? Read this blog where we have discussed everything from steps to monetization strategies.

Read MoreMay 10, 2024

The Ultimate Guide to Building a Job Portal in 2025Struggling to develop a job portal in 2024? Not anymore! Read this comprehensive guide to gain insights into creating a successful job portal on budget.

Read MoreMay 07, 2024

How to Develop an App Like DoorDashThis blog discusses the steps involved in creating a successful app like Doordash, from market research to post-launch support. Read now.

Read MoreMay 03, 2024

How to Build An App Like AirbnbLearn everything about building a robust vocational rental app like Airbnb, from steps and cost to features in this detailed guide.

Read MoreApr 29, 2024

How AI is Transforming Electric Vehicles: Benefits and ChallengesWith AI evolving, you can expect to see these transformations in the EV sector such as smart charging stations, route optimization, and more.

Read MoreApr 25, 2024

AI Coach in Your Pocket: Exploring the Benefits of AI-Powered Fitness AppsDo you want to know the benefits of AI-powered fitness apps or how developers can overcome AI-fitness app development challenges? Read this blog.

Read MoreApr 18, 2024

The Future of Fitness: How AI is Revolutionizing Workout AppsRead this blog to learn how to build a fitness app, the compliance involved in building fitness apps, the cost to build a fitness app, and more.

Read MoreApr 15, 2024

How to Make an App Like Snapchat: Expert Guide and Tips [2024]On average, the cost varies between $40,000 and $300,000. But factors like the app’s complexity, UI/UX design, and more affect the cost.

Read MoreApr 12, 2024

How to Build AI-Powered Apps in 2024: A Step-By-Step GuideFollow these 6 steps to successfully build AI-powered apps. Also, check the cost of development and use cases of AI-powered apps.

Read MoreApr 10, 2024

Chatbots in E-commerce: Benefits + Use Cases ExplainedRead this blog to understand the basics of chatbots in e-commerce, their benefits, challenges during integration, use cases, and future trends.

Read MoreApr 08, 2024

Safeguarding Your E-commerce Site: Tips and Strategies for SecurityWe have discussed common attacks on e-commerce websites and essential tips to improve their security. Read the full blog to bulletproof your website.

Read MoreApr 02, 2024

E-commerce Personalization: How to Tailor the Shopping Experience for Every CustomerE-commerce personalization impacts 90% of customers. So, follow these e-commerce personalization strategies for engaging customer experience.

Read MoreMar 26, 2024

The Ultimate Guide to Optimizing Your E-commerce Website for Search EnginesThis ultimate guide discusses ways to optimize e-commerce site through 6 impactful best practices. Follow these tips to have a well-optimized website.

Read MoreMar 19, 2024

Unlocking Efficiency: How Healthcare Mobile App Development Services Are Streamlining OperationsWant to know how healthcare mobile app development services are streamlining operations? Read this detailed blog to gain a complete understanding.

Read MoreMar 14, 2024

Clutch Names Protonshub Technologies as one of the Game-Changing Android App Developers in IndiaProtonshub Technologies is named one of the game-changing Android app developers in India. Do you have a project? Contact us. We’d love to help.

Read MoreMar 12, 2024

Artificial Intelligence in the Healthcare Industry: A Statistical AnalysisAI in healthcare is expected to increase to $187 billion by 2030, suggesting that AI is capable of delivering better outcomes

Read MoreMar 01, 2024

How Much Does It Cost to Build An App [Complete Cost Breakdown]Have you ever heard the phrase “there’s an app for everything”? Well, it’s true!

Read MoreFeb 27, 2024

Google Gemini Pro: Everything You Need to Know About This Next-Gen AIGoogle, the tech giant, has made headlines with Gemini Pro, a flagship suite of generative AI models, services, and apps. After releasing Bard as a trailer, Google launched Gemini Pro AI, the most capable and Largest Language Model (LLM). This AI technology is guaranteed to leave a domino effect on all of Google’s products and mobile applications.

Read MoreFeb 23, 2024

Salesforce Development Lifecycle: Stats, Process, Models, And BenefitsSalesforce is a growing tool that is swiftly becoming popular in various industries. That’s because it has all the necessary features that a business needs to accelerate its growth. From lead management, and managing & storing customer data to improving, Salesforce can do it all.

Read MoreFeb 19, 2024

A Comprehensive Guide to Creating Software GDPR-CompliantWith technology at the forefront, businesses and their possessed assets have been at risk of cyber theft and data breaches.

Read MoreFeb 16, 2024

AI in E-commerce: 8 Ways It’s Transforming the BusinessArtificial Intelligence no longer revolves just around scary and futuristic movies; it is making headlines and can be found everywhere. Among the list of industries that are hopping on the trend of adopting AI, e-commerce has been an early adopter in implementing and improving through the power of AI.

Read MoreFeb 13, 2024

Top Emerging Web Design Trends for 2024 and Beyond [Updated]With the fresh start of 2024, it's time to look at the top emerging web design trends for this year and beyond.

Read MoreFeb 08, 2024

Best Practices For Your Mobile App Security in 2024Did you know that global phone usage has increased to 7.07 billion?

Read MoreFeb 05, 2024

AI In Healthcare: Benefits, Applications, and Common ChallengesAI in healthcare has become more effective in helping physicians and other healthcare providers. It not only offers a genuine chance for professional advancement but also makes healthcare services more affordable.

Read MoreJan 30, 2024

Choose the Best Developers To Build Your Dating AppA dating app is an excellent way to socialize and find your love matches. Or can meet your better half through a casual relationship as well.

Read MoreJan 25, 2024

Choosing the Right Tech Stack for E-commerce Mobile Apps in 2024In the ever-changing world of e-commerce, choosing the right technology stack for your e-commerce app can make all the difference.

Read MoreJan 22, 2024

Tech Meets Love: The Coolest Features Coming to Dating Apps in 2024Online dating apps have established themselves as a key player in social connections. As a part of the dramatically changing tech landscape, dating apps are evolving the way people build relationships.

Read MoreJan 19, 2024

Front-End Development in 2024: Next.js vs React for Building Modern Web ApplicationsReact has been the top choice of developers for a long time but then it started demanding something more. That’s when the Next.js entered with its better capabilities.

Read MoreJan 15, 2024

White-Label vs Custom-Built Taxi App: Which One is Better?Did you know the revenue of the taxi booking industry is expected to reach US$165.60bn in 2024?

Read MoreJan 11, 2024

Unlocking Business Potential with Salesforce DevelopmentDid you know that investing in Salesforce development services can greatly benefit businesses?

Read MoreJan 08, 2024

Exploring the Best Back-end Development Trends For 2024Are you feeling the pressure to keep up with the ever-evolving user expectations? If yes, check out the top trends of 2024 that will help you stay relevant in the market.

Read MoreJan 03, 2024

The Role of AI and AR in Modern Salon Booking AppsArtificial intelligence is dominating the business activities of almost all industries, including the beauty salon sector. From appointment scheduling to marketing & promotions, artificial intelligence in the beauty industry is emerging as a new trendsetter in the marketplace.

Read MoreJan 02, 2024

A Comprehensive Guide To User Personas In Modern App DevelopmentIf your product has a good amount of users, it means the product has the potential to become successful! But you also need to figure out what group of people does not resonate with your business or products.

Read MoreDec 28, 2023

Scalability Challenges in MVP Development and How to Overcome ThemMVP app development has always been a smarter choice. But scaling it into a full-fledged product is a complicated process.

Read MoreDec 26, 2023

The Role of Artificial Intelligence in Enhancing OTT Content Recommendation AlgorithmsWith OTT platforms gaining popularity, the way we consume digital content has changed.

Read MoreDec 21, 2023

AR and VR in E-Commerce Apps: Enhancing the Online Shopping ExperienceDid you know that almost 78.65% of shoppers are known to abandon their shopping carts? While the shopping cart abandonment reasons are multiple, there is one sure-shot way to persuade customers to complete a purchase before they leave the website.

Read MoreDec 18, 2023

React UI Libraries for Building Impressive Web ApplicationsDid you know that almost 75% of consumers have admitted to judging the credibility of a website by the way it looks? It means a large part of a website’s success depends on the design and quality of the website.

Read MoreDec 15, 2023

Things to Consider While Choosing a Software Development CompanyThe stakes get high when hiring a software development company because you need to invest a significant amount of resources, capital, and time in the process. Also, with so many companies offering custom software development services, choosing the right vendor becomes difficult.

Read MoreDec 12, 2023

How to Build a Salon Appointment Booking App?Finding the best salon app and booking an appointment can be a daunting task. It can take too much time and energy, and people rarely have time to call a salon to book an appointment. This thing has created a gap in the market.

Read MoreDec 08, 2023

Complete Guide to E-commerce App Development: Cost & FeaturesEver since the 2000s, the eCommerce industry has been on a meteoric rise, with no sign of downfall.

Read MoreDec 05, 2023

9 Reasons Why You Need an E-commerce Mobile App in 2024When was the last time you had purchased something online? A majority of you would say a week or two ago.

Read MoreNov 30, 2023

How Much Does It Cost To Hire App Developers In Florida?Hiring mobile app developers is a challenging task, but not when you know the right process.

Read MoreNov 29, 2023

The Future of E-commerce in 2024 and BeyondA study has revealed that worldwide e-commerce sales have reached $5.7 trillion in 2022 This figure shows an optimistic projection of this industry for the upcoming years.

Read MoreNov 27, 2023

Mobile App Architecture Designing: Your Step-By-Step Guide for 2024The mobile app development market is incorporating new technologies and safety standards for steady growth. These mobile apps offer a better user experience, which has increased our dependency on them, making them a one-stop solution for day-to-day tasks.

Read MoreNov 23, 2023

Scaling Product After Successful MVP Launch: A Complete GuideInvesting in MVPs or Minimum Viable Products is far better than investing in a full-fledged product because it provides clear market validation and audience feedback.

Read MoreNov 20, 2023

Swipe Right On Safety: 9 Things To Consider When Creating Dating AppsThe use of dating apps has increased drastically, causing the market to grow to $8.64 billion. As per research, out of every 10, almost 3 adults are registered on dating apps.

Read MoreNov 14, 2023

How Much Does It Cost to Build a Fantasy Sports App?The World Cup fever is over with the winning strike of the Australian cricket team, but the craze for fantasy sports apps is still there.

Read MoreNov 10, 2023

A Complete Guide to Fantasy Sports App Development in 2024Almost everyone of heard about Dream11 at least once in their life, which is nothing but a fantasy sports app. For all the sports fan out there, apps like Dream11 is an innovative way to connect users with their favorite sports in a more realistic way.

Read MoreNov 07, 2023

The Role of User Feedback in MVP DevelopmentBuilding a successful minimum viable product (MVP) app is an important step in any organization’s development process. The final goal of a minimum viable product is to validate the product idea quickly in the market while also reducing the associated risks with the development process.

Read MoreNov 03, 2023

Impact of Digital Transformation on Enhancing Customer ExperiencesIn today’s soaring dependency on digital platforms, organizations are countering many challenges to deliver exceptional customer experiences. This is where digital transformation opens new doors of opportunities.

Read MoreOct 31, 2023

How to Create a Dating App at Low Cost?Are you considering developing a dating app but concerned about the price?

Read MoreOct 30, 2023

Choosing the Right Tech Stack for Your MVP: Best PracticesBusinesses that are willing to grow faster must focus on scaling properly. But how can it be done? The key lies in selecting the right tech stack so you can create a functional and robust MVP.

Read MoreOct 27, 2023

10 Things to Consider While Developing a Mobile AppWith more people relying on mobile apps for day-to-day tasks, this industry is booming with no signs of slowing down. A report by Statista has estimated that the number of mobile app downloads is going to cross

Read MoreOct 24, 2023

Unlock the Success: Top 10 Benefits of Hiring Dedicated DevelopersWith the increase in globalization, outsourcing dedicated developers have become a popular and cost-effective solution.

Read MoreOct 19, 2023

Collaborating with App Developers: A Guide for Non-Technical Startup FoundersDid you know that 15.4% of the US population is involved in startups yet the rate of failure for the same is considerably high? But why does it happen? It happens due to lack of funds and high product demand.

Read MoreOct 17, 2023

Guide to Building an On-Demand Courier Delivery ApplicationThe on-demand apps have changed the user experience in a positive way. Among these, the courier delivery apps have greatly contributed to the customer’s rising demands.

Read MoreOct 13, 2023

How to Develop a Logistics App like PorterDid you know that online transportation services have developed into a leading industry that holds the power to pique the public’s interest? In the year 2022, the global transportation market was valued at

Read MoreOct 11, 2023

How to Develop Travel App - Features, Cost & Technology StackDid you know that the digitalization of the travel industry has changed many traditional processes? For instance, now people use travel apps to make reservations, buy tickets, choose destinations, and get around. The trip planning has become much easier and quicker.

Read MoreOct 09, 2023

Important Things to Consider in Software Development [Full Guide]Do you know what makes or breaks a successful software development? It’s the lack of strategic planning.

Read MoreOct 06, 2023

Effective UI/UX Strategies for E-commerce App SuccessOne of the biggest challenges for e-commerce businesses is how to convert visitors into customers. By providing relevant products and services, you can make more people visit your website. But there’s more to the story.

Read MoreOct 02, 2023

Prototype vs. MVP: Which One Do You Need?Businesses of any size willing to develop a successful product can use the technique of prototype or MVP. While using one of these techniques, companies should get feedback from their targeted customers to improve their position in the market and reduce costs.

Read MoreSep 29, 2023

6 Ways Python Development Can Benefit Your BusinessIn recent years, Python has become one of the most recognizable programming languages worldwide. It is being used in everything from building websites and software testing to machine learning.

Read MoreSep 25, 2023

Challenges and Solutions in Travel App DevelopmentTraveling is not just a luxury, it has become a hobby for many people. That’s because when we travel, meet new people, learn new things, and click memorable pictures. Also, it has emerged as a new source of income.

Read MoreSep 21, 2023

How to Track Content Marketing KPI in B2B MarketingCompanies around the globe are spending almost one-third of their budget on content production and distribution.

Read MoreSep 18, 2023

How to Develop a Doctor’s Appointment Booking App (Step-by-Step Guide)Believe it or not, we are heavily dependent on applications to complete our day-to-day tasks. Be it taxi booking, grocery, or dating, we need apps to do almost everything.

Read MoreSep 14, 2023

Choosing the Right Technology Stack for Your Taxi Booking AppNone of us have ever thought about getting picked up and dropped off by a taxi without yelling out the directions to the driver. But, with the advent of technology and the emergence of on-demand taxi-booking platforms, all of this has been like smooth sailing on a calm sea.

Read MoreSep 13, 2023

Challenges and Solutions in Healthcare App DevelopmentBy the year 2028, the global healthcare app industry is expected to reach $314.60 billion. It is because, with the rise in demand for digital healthcare, the need for developing health solution apps has also increased.

Read MoreSep 08, 2023

Website Conversion Rate Optimization Strategies in 2023One of the main purposes of a website is to drive conversion. The more people sign up for the products and services, the better will be the revenues.

Read MoreSep 06, 2023

How Much Does It Cost to Develop a Dating App Like Hinge?Fun and interactive dating apps like Hinge have changed the way people meet and date.

Read MoreSep 04, 2023

Boosting Productivity: How Implementing an ERP System Can Streamline Your Operations?If you look back to the time when manually handling operations was the only way to get tasks done seems quite challenging. Now, since technology has significantly emerged, all these tasks can be done in the blink of an eye.

Read MoreAug 30, 2023

Building Scalable Web Applications with ReactJS in 2023With the emergence of new technologies, developing mobile-friendly applications has become a common phenomenon. However, each project demands the use of different technologies.

Read MoreAug 24, 2023

9 Reasons: Why Startups Should Hire Developers on ContractWhether you plan to start a small or large business, the process can be challenging. That’s because you need to conduct detailed market research for your product or service to create a competitive marketing strategy.

Read MoreAug 23, 2023

How Does ERP Help in the Manufacturing Industry?Is your organization keeping up with the ever-changing pace of the manufacturing Industry?

Read MoreAug 21, 2023

How to create a dating app like Tinder?Ever wanted to experience what dating another person feels like but don’t know how? Well, it can be embarrassing to just ask any random guy/girl if they wanna date.

Read MoreAug 18, 2023

11 Common Problems In the Manufacturing Industry That ERP SolvesThe Enterprise Resource Planning (ERP) system in the manufacturing sector has transformed many organizations from their core. This intense growth has only been possible due to ERP’s capacity to unlock better opportunities and efficiency in solving manufacturing issues.

Read MoreAug 17, 2023

The Future of Taxi Booking Apps: Trends and InnovationsWhen was the last time you halted a taxi by waving your hand? Probably you don’t remember and neither do any of us when we did the same because we have gotten into the habit of booking taxis via mobile phones.

Read MoreAug 14, 2023

How to build a stock trading app (Step by step guide)Does the emergence of stock trading applications intrigue you enough to invest in one by yourself?

Read MoreAug 10, 2023

React Hooks Deep Dive: Advanced Usage and Patterns in 2023Among JavaScript developers, React remains the preeminent choice for enhancing user interfaces. Its emphasis on functional programming principles, such as pure functions, props, and state, empowers engineers to craft robust web applications.

Read MoreAug 07, 2023

How Does Your Website’s UI/UX Impact Your Business Growth?Are you tired of dealing with increasing bounce rates, unsatisfied customers, and decreasing website visitors?

Read MoreAug 04, 2023

The Role of Artificial Intelligence in FinTech: Revolutionizing Customer Experience and Risk ManagementArtificial intelligence has molded the way how FinTech Industry works.

Read MoreAug 03, 2023

Benefits Of Hiring an India-Based Ruby on Rails Development CompanyAre you having trouble deciding whether to hire a Ruby on Rails development company from India?

Read MoreJul 31, 2023

Emerging Trends in Artificial Intelligence and Machine Learning: The Future of ITArtificial intelligence (AI) and machine learning (ML) are rapidly transforming the world of information technology (IT).

Read MoreJul 28, 2023

Exploring GraphQL in Ruby on Rails: A New Approach to API DevelopmentThe new age of web development has created enormous opportunities for new software, which needs APIs for seamless communication. The fact isn’t hidden from anyone that APIs (Application Programming Interfaces) are essential to creating modern applications.

Read MoreJul 26, 2023

Exploring React Native Libraries and Tools for 2023 DevelopmentReact is one of the most used javascript libraries among developers who wants to build a scalable and robust mobile application. It will continue to flourish in the coming years, owing to the advancement and innovations.

Read MoreJul 23, 2023

Exploring the Impact of Fintech in Financial Services: Disruption and OpportunitiesRecent years have seen a significant change in the banking sector as new fintech businesses have appeared, offering cutting-edge technologies and services that alter how banks conduct business.

Read MoreJul 21, 2023

The Rise of Telemedicine: Advancements in Healthcare Delivery and AccessibilityEver experienced a situation where you needed immediate medical assistance but had no one near you? Well, this is a common situation in rural areas where good medical service is located far from where you live.

Read MoreJul 14, 2023

Low-Code and No-Code Development: Accelerating Application DeliveryWhen they say choose an IT career, most of them meant programming. But what if I say you don’t need to be a programmer in order to develop a website or an application?

Read MoreJul 13, 2023

How to Build a Mobile App With a Limited Budget?There was a time when only large organizations considered having an app for their business. Now, the times have changed, every company nowadays, despite its size is looking to have an app developed for N number of good reasons.

Read MoreJul 12, 2023

How to Build a Progressive Web App (PWAs) with ReactApps were just a mere idea when it was first introduced decades ago. People didn’t have any idea about how these apps were going to change their lives completely.

Read MoreJul 11, 2023

Leveraging Sales and Marketing Alignment for Revenue GrowthSales and Marketing, both are essential pillars of an organization. The fact that sales department converts the leads to closure, and the marketing department creates brand awareness via advertising, content creation, and social media handling.

Read MoreJul 10, 2023

Unleashing the Power of Personalization: How Automation Can Supercharge Your Sales and Marketing EffortsToday, every customer looks for achieving tailored experiences that meet their needs. Personalization is a significant factor when it comes to sales and marketing.

Read MoreJul 07, 2023

Streamline Your Sales Process with Marketing Automation: A Step-by-Step GuideImagine having tons of work on priority and you are stuck doing chores that can be automated if you would have thought in a more innovative way.

Read MoreJul 03, 2023

The Role of AI in Banking Software DevelopmentPeople have already anticipated the potential of AI, thanks to the tools like ChatGPT, Adobe Firefly, Writesonic, and many more. Artificial Intelligence has all the hype for today and its implementation in the banking industry has raised many concerns and opportunities.

Read MoreJun 28, 2023

Top 9 Reasons to Invest in a Mobile App for Your RestaurantGood restaurants are needed everywhere, similarly, those restaurants need a good mobile application. Wondering why? Let’s find out.

Read MoreJun 26, 2023

The Rise of Fantasy Apps: Exploring the Trend and Market OpportunitiesTechnology is making fantasy apps more popular than ever before, despite traditional fantasy sports' popularity.

Read MoreJun 20, 2023

Exploring Ruby on Rails Framework: Key Features and BenefitsHave you ever heard of RoR or Ruby on Rails?

Read MoreJun 19, 2023

10 Tips and Tricks to Choose the Best App Development Partner for Your BusinessA well-designed app is not easy to create today. A single app must be developed over the course of several months, and obtaining the desired app may take up to ten months.

Read MoreJun 15, 2023

How to Build an Instant Grocery Delivery App: A Guide for Business OwnersHow many of you have thought at least once about fulfilling our grocery needs in the comfort of our homes? Almost everyone, right?! We are in an era where almost everything can be delivered to your doorstep within no time, and grocery apps are not left behind in the lane as well.

Read MoreJun 14, 2023

Performance Optimization Techniques in React Native TechnologyReact Native is without a doubt the method of choice for developing hybrid apps in the future. It provides high performance, adaptability, scalability, speed, and agility.

Read MoreJun 12, 2023

How to Integrate Front-End Frameworks with Ruby on RailsDo you know building solid and dynamic web apps with Ruby on Rails (RoR) and front-end framework integration may be quite effective?

Read MoreJun 08, 2023

A Guide To Hiring Full-Stack Developers For Web ApplicationsInstead of making several purchases, we always look for a package, whether it's making hotel reservations, dining out, or hiring a developer.

Read MoreJun 07, 2023

Everything You Should Know About Web App Development's Impact on Your BusinessThere’s a reason why the IT sector is at its peak and the reason is surging web app development. The digital world generates a huge demand for different websites and applications, aiding in revenue generation for businesses.

Read MoreJun 06, 2023

How Blockchain Boosts Healthcare? Trends,Innovations & Advantages!In recent years, blockchain technology has emerged as a game-changer in various industries, and one area where its potential impact is gaining significant attention is healthcare. The decentralized and secure nature of blockchain holds immense promise for transforming the healthcare paradigm.

Read MoreJun 05, 2023

How to build a RESTful APIs: Power Up Your Development with Ruby on RailsFirst of all, APIs. What are they?

Read MoreJun 01, 2023

Top 15 Best Database For Web Application Development to Use in 2023Now imagine you have created a website, but do you have proper data and record about how many users are coming to your website and what pages they have visited?

Read MoreMay 29, 2023

5 Ways An LMS Can Revolutionize Your Organization's Training ProgramsLearning has come a long way from the days of writing every sentence on paper or keeping hundreds of notebooks.

Read MoreMay 24, 2023

How to Choose the Right Learning Management System for Your OrganizationThere was a time when e-learning was an imaginary concept but it turned into reality a long ago, and COVID-19 restrictions have fueled this industry. All this became possible with the learning management system or simply LMS.

Read MoreMay 23, 2023

5 Ways a Learning Management System (LMS) Can Revolutionize Your Organization's Training ProgramsDo you concur that failing to adjust to change can sometimes result in a significant loss?

Read MoreMay 22, 2023

The Impact Of ChatGPT On Social MediaDo you know which is the most AI-Powered tool currently in the market?

Read MoreMay 16, 2023

The Future of Learning Management Systems: Trends and Predictions for 2023 and BeyondNo one believed earlier when someone said ‘Learning can be fun’! However, technological advancements have made the statement possible. There are several methods coming day by day to promote an interactive learning option in order to make the process enjoyable.

Read MoreMay 15, 2023

How is AI Transforming the Future of the Logistics Industry? (Benefits and Use Cases)AI has taken the world by storm in the last few years, and it is only going to continue at an even better pace. Since so many industries are revolutionizing with artificial intelligence, logistics is also not left behind.

Read MoreMay 11, 2023

Taxi Booking Mobile App Development Cost & FeaturesAre you still sending your family members to bring a taxi (Old traditions are good to have but don’t you think change is the new normal)? If yes, then you should stop! Local taxi owners charge a hefty amount of money for going to places that can be reached at half of that price.

Read MoreMay 10, 2023

How To Develop A Matrimonial Mobile App? A Complete Guide (Features, Process & Cost)One of the most crucial aspect of everyone's life is marriage. However, it can be difficult these days to find the right partner.

Read MoreMay 08, 2023

How AI Is Transforming The Healthcare Industry?Does Artificial intelligence have the potential to transform the healthcare industry?

Read MoreMay 05, 2023

Main Reasons Why UI/UX is the Final Stage for Widespread Web3 AdoptionDo you know that implementing the write strategy with UI/UX design can lead to mass adoption of Web3 platforms?

Read MoreMay 02, 2023

How AI Is Transforming The Future Of EdTech Industry?Integration of AI and machine learning is taking the world to the next level and the education sector did not remain untouched from this.

Read MoreMay 01, 2023

How to get investors for your mobile app startup?Are you a new startup trying to find out ways to grow your business? Or are you looking for ways to grow your existing mobile app business?

Read MoreApr 29, 2023

How to Make an On-Demand Medicine Delivery App Like 1mg?A healthy body is our most precious possession. The pandemic made us realize the value of a healthier body and more importantly, immunity. It is sad to convey that there was a time in life when almost each and every person relied on medicines.

Read MoreApr 26, 2023

How to Develop a Fantasy Sports Mobile App like Dream11?Who doesn’t like sports?

Read MoreApr 25, 2023

Advantages of Utilizing Ruby on Rails for Application Development in 2023The fast-paced environment waits for no one, and Ruby on Rails (RoR), understood the assignment better than any other framework. Productive frameworks like Ruby have transformed the way of working in the web development culture all over the world.

Read MoreApr 24, 2023

How to create a mobile app like UnacademyThinking to build a mobile app like Unacademy?

Read MoreApr 17, 2023

Top 8 Reasons Why Your E-Commerce Business Needs a Mobile AppWant to scale up your eCommerce business revenue?

Read MoreApr 13, 2023

How To Build A Telemedicine App in 2023? (A-Z Guide)Have you heard of the term "Telemedicine"?

Read MoreApr 12, 2023

How to Create the Wireframe of Your Application in 2023Are you wondering how wireframes can help your application stand out?

Read MoreApr 06, 2023

10 Tips to Create a Modern App UI/UX Design for Your BusinessThere are a lot of modern applications, so what makes some of them unique in the market?

Read MoreApr 05, 2023

Why use Ruby on Rails for your product development in 2023A wide variety of frameworks are available on the market. However, Ruby on Rails web application development is the most popular and preferred by many developers and firms.

Read MoreApr 04, 2023

How to Develop an Agritech Mobile App?Digital technology is transforming agriculture and food production on a global level.

Read MoreMar 28, 2023

Why Do USA Clients Prefer to Outsource Projects to IndiaAre you planning to outsource your next project to India?

Read MoreMar 28, 2023

10 UX/UI Design Trends to Watch for in 2023UI/UX design is a creative field that requires a unique approach every time you create something new. It also helps businesses in

Read MoreMar 27, 2023

Top 8 Benefits of ReactJS For Your Application DevelopmentThe new digital world can’t live without mobile and web applications

Read MoreJan 20, 2023

10 Game-Changing Web Development Trends of 2025 Every CTO Must KnowThere are around 1.14 billion websites in existence right now. The market for web development is expanding quickly, and in this cutthroat competition, those who stay on top of the trends succeed.

Read MoreJan 17, 2023

Why You Should Hire A Dedicated Remote Developer In 2023Since working remotely is becoming more common, people are often doing it these days. Employers can save money by recruiting remote workers since there are fewer overhead costs and lower employee turnover.

Read MoreJan 11, 2023

How To Find The Right MVP Developer For Your Startup IdeaAre you a startup trying to figure out how to maximize the potential of a minimum viable product (MVP)?

Read MoreDec 28, 2022

How Technology Is Transforming The Logistics Business?Online shopping trends have accelerated eCommerce growth in recent years, which has stimulated the growth of logistics services to optimize the supply chain management system.

Read MoreDec 22, 2022

Healthcare Mobile App Revenue Tips - 8 Ways To Grow Your BusinessAre you trying to find ways for your mobile healthcare app to make money but having trouble doing so?

Read MoreDec 16, 2022

Impact Of Technology And Automation On EducationAutomation is challenging, but what comes with hardships always pays off. Any industry loss is always attributed to unending demands and resource scarcity.

Read MoreNov 10, 2022

Top Mobile App Ideas For Restaurant And Food Industry 2022-23Globally, the food industry is rapidly expanding. From USD 111.32 billion in 2020, it is anticipated to increase to USD 154.34 billion in 2023. Inevitably, mobile apps are now a part of life in the food industry.

Read MoreSep 01, 2022

How Agile Technology Benefits Software Development?"Still, stuck at why to use agile methodologies? We are here to assist you in your search. "

Read MoreAug 03, 2022

Top React Developer Tools For Mobile App DevelopmentImproving performance can be tedious for a React Developer, but what makes it achievable are the right tools they choose.

Read MoreAug 03, 2022

Hire Remote Developers!Dedicated resource hiring is preferred by a majority of organizations that intend to put a professional IT team in place for building a website, mobile application, or customized software.

Read MoreJul 13, 2022

Key Reasons To Outsource Web DevelopmentTime is money and who better than a smart business person can understand this? If you also run a business and want to save time, this blog is for you.

Read MoreJul 08, 2022

Advantages Of Hiring A Global Staffing Agency For Your Start-UpThe struggle of hiring a perfect candidate for the job is very well-known for a business owner. But have you ever wondered how easy this process can get if you consider taking help from a global staffing agency?

Read MoreJul 05, 2022

Most Preferred Framework For Mobile App Development 2024It’s no surprise that mobile apps have become an integral part of everyone’s lives. Whether you want to choose a good spot for an outing or a book to read, taking the smartphone out of your pocket remains constant, because you have apps for everything.

Read MoreJul 01, 2022

An In-Depth Guide to Content Management System (CMS)Implementing a Content Management System (CMS) can empower your business website. It can be a game-changing investment decision to godspeed up your digital journey.

Read MoreJun 28, 2022

The Ultimate Guide To Mobile Application Development 2024The ever-rising demand for custom software development has revolutionized modern-day businesses with tremendous access to information

Read MoreJun 27, 2022

Microservices The Shining Star Of New Age IT InfrastructureChanging design patterns and race to substantiate the modern design and delivery approach Microservices architecture has been the face of the shift and has been a potential front runner in mainstream design process and methodology

Read MoreJun 21, 2022

Multi Tenant Architecture!As per a report by Gartner, by the end of 2022, the cloud services industry is expected to grow exponentially by 40%, and the market size of the cloud services industry will be approximately 3X the overall growth of IT services.

Read MoreJun 10, 2022

Trending UI/UX DesignThe business value of design aesthetics is no more a question to be asked. In this era of digital transformation, user experience is what drives a software product’s success, whether B2B or B2C. Hence, it has become critical for businesses to understand the significance of seamless and unique UI/UX design services for their product.

Read MoreFeb 20, 2025

HIPAA Compliant App Development: A Detailed Guide for 2025Learn key steps for HIPAA-compliant app development to ensure secure healthcare solutions. Discover best practices for data security and compliance.

Read MoreFeb 18, 2025

How to Create Medical Billing SoftwareGet a step-by-step guide to developing medical billing software. Learn key features, cost, and required tech stack for the development process.

Read MoreFeb 12, 2025

How to Make an App like AstrotalkWant to create an astrology app like AstroTalk? Learn about key features, development costs, future trends, development process, and more.

Read MoreTurn Your Billion-Dollar Dating App Idea Into Reality!

- Contact Us

-

How Biometrics Make Payments Easy and Safe

Imagine walking into a store, grabbing what you need, and with just a quick touch of your finger, your payment is done. This is the power of biometric payments, a technology that uses your unique physical traits to simplify how you handle transactions.

Honestly, the role of biometrics in modern banking is very important. And with rising concerns about security and fraud, more people are choosing biometric payment options.

But how do these systems work?

When you register your biometric data with a payment provider, that information is securely stored. The next time you want to make a purchase, all you have to do is use your biometric data to confirm your identity. In just seconds, your identity is verified, and the payment is completed without any hassle.

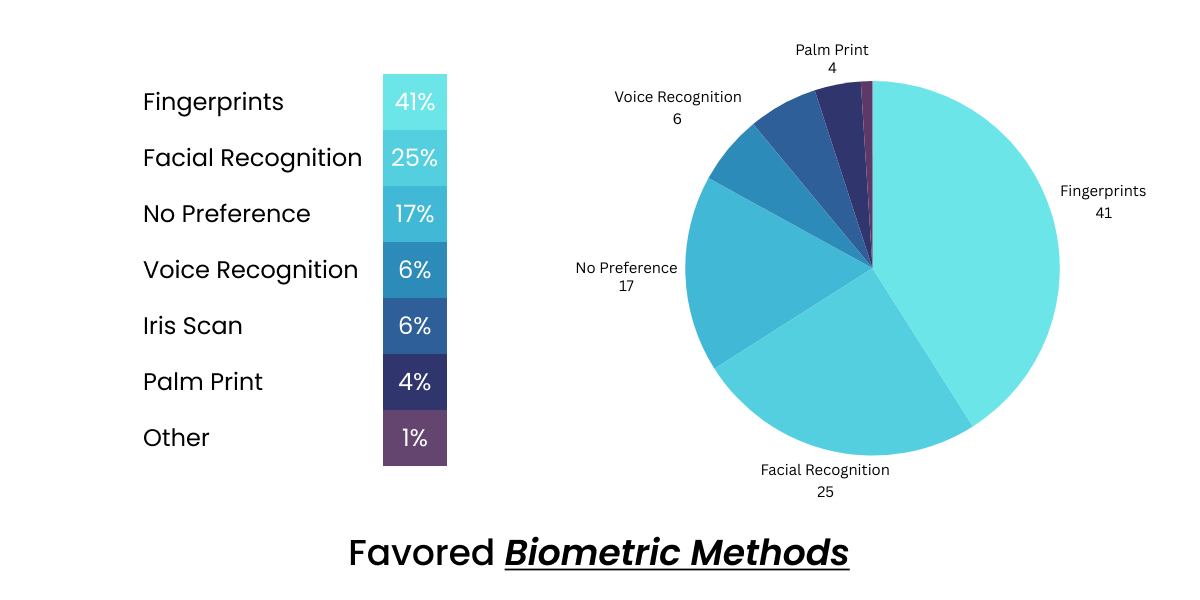

The biometric payment market was valued at around $8.4 billion in 2023, and it will cross $37.4 billion by 2033, at a CAGR of 16.3%. This rapid increase shows that consumers see biometrics as a safer choice compared to traditional payment methods like cash or cards.

In this blog, we will discuss how biometric-based payment systems work, the benefits they bring to banking, and more.

- Advantages of biometrics in banking

- Different types of biometric payment systems

- How do biometric systems work?

- Challenges in biometric systems

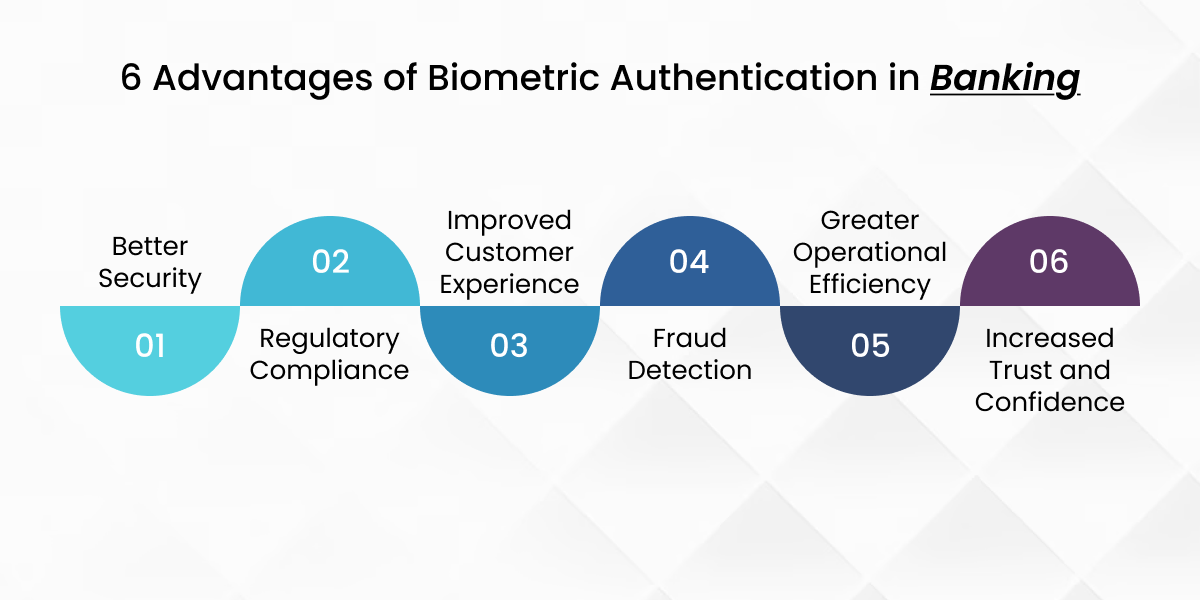

Advantages of Biometrics in Banking

Biometric technology is changing how we bank, bringing numerous benefits that make everything safer and easier. By using unique traits like fingerprints and facial recognition, banks now offer a more secure way for customers to access their accounts and make transactions.

Below are some of the key advantages of biometrics in banking:

1. Better Security

One of the biggest perks of facial recognition in banking is security.

Your fingerprints and face are one of a kind, making them super hard for anyone to copy or steal. This gradually decreases the risk of fraud and unauthorized access to your accounts. Unlike passwords or PINs, which can be hacked or forgotten, biometric data keeps your money safe and sound.

2. Regulatory Compliance

Biometric authentication helps banks stay on the right side of the law, especially when it comes to KYC and AML rules. By using biometric data to verify your identity, banks can make sure they’re dealing with real customers. This helps reduce financial crime, protects the bank, and also builds trust among customers.

3. Improved Customer Experience

Biometric payments eliminate the hassle of remembering complicated passwords or searching for your card. Just use your fingerprint or face to get into your account quickly. This makes banking a lot smoother and faster.

4. Fraud Detection

Biometric systems are smart enough to monitor how you usually use your account. If something seems off, like trying to log in from a different place, the system can flag it right away. This kind of real-time monitoring allows banks to catch potential fraud before it becomes a problem.

5. Greater Operational Efficiency

Traditional banking processes can be slow and daunting. Enters biometric authentication!

It cuts through all that red tape, making identity checks quicker and easier for everyone involved. With less time spent on manual checks, banks can offer their services faster and more efficiently.

6. Increased Trust and Confidence

Security is a big deal in banking. By using biometric technology, banks show that they’re serious about protecting customers' personal information. This focus on safety helps build trust and confidence among customers, making them feel more comfortable using their services.

[Also Read: How Blockchain Technology Can Revolutionize the Fintech Industry]

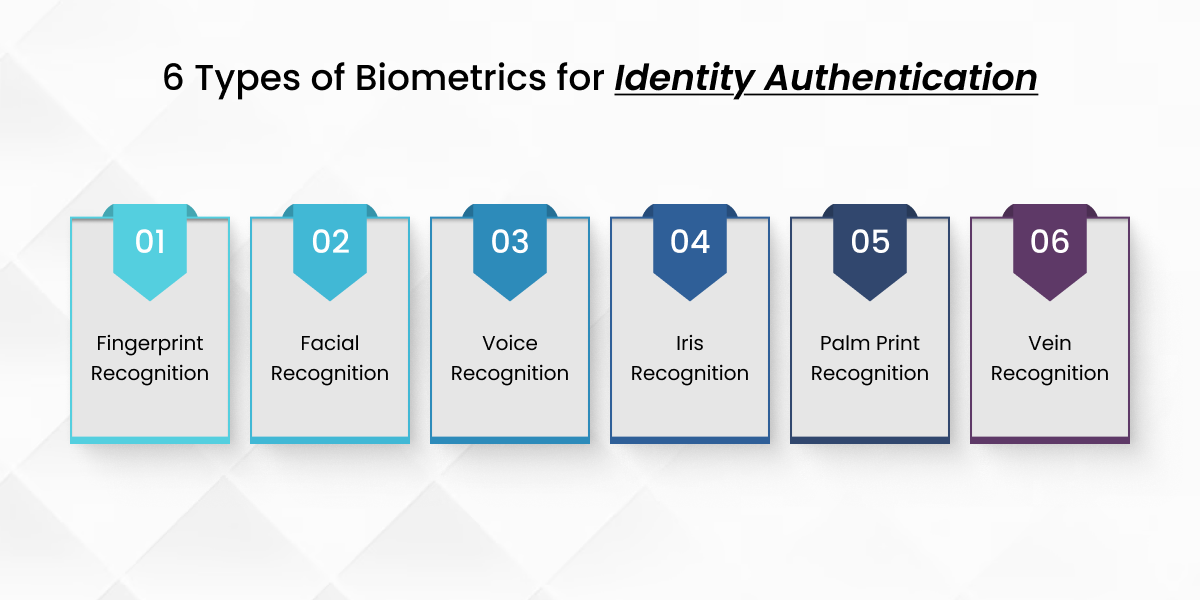

Different Types of Biometric Payment Systems

Biometric payment systems are changing the way we perform transactions by using our unique physical traits for authentication. These systems make transactions faster and more secure, allowing us to leave behind traditional methods like cash and cards.

Below are different types of biometric payment systems for authentication:

1. Fingerprint Recognition

The fingerprint-based payment system is one of the most common biometric methods. It works by capturing the unique patterns of ridges and valleys on your fingertip. While making a payment, you can simply place your finger on a scanner that matches your fingerprint with the stored data.

Use Case: This method is popular in smartphones and payment machines, making it easy for users to confirm their transactions quickly.

Challenge: While fingerprint recognition is reliable, it struggles in situations when fingers are wet or dirty. Additionally, some users may feel uncomfortable with the idea of their fingerprints being stored digitally.

2. Facial Recognition

Facial recognition technology analyzes different features of your face, such as the distance between your eyes and the shape of your jawline. While making a payment, you simply need to look at a camera that scans and verifies your identity.

Use Case: This system is popularly used in mobile payment apps because it provides a fast and contactless way to complete transactions.

Challenge: One big issue with facial recognition is that it can be less effective in low-light conditions or if you’re wearing sunglasses. There are also concerns about privacy and how facial data might be used.

3. Voice Recognition

Voice recognition uses the unique characteristics of your voice, like pitch and tone, to verify your identity. When making a payment, you can simply say a specific phrase or command to authenticate.

Use Case: This method is commonly used in hands-free situations, like drive-throughs or virtual assistants that process payments with voice commands.

4. Iris Recognition

Iris recognition scans the unique patterns in your eyes to confirm your identity. This method is highly accurate and works by capturing an image of your iris and comparing it to stored data.

Use Case: While iris recognition is not common for everyday payments, it is often used in high-security environments where accuracy is necessary.

Challenge: The main drawback is that iris scanners need special equipment, making them less accessible for everyday retail transactions compared to other methods.

5. Palm Print Recognition

Palm print recognition captures the unique vein patterns and surface features of your palm. To pay, you simply need to place your palm on a scanner that reads these details for verification.

Use Case: This technology is becoming popular in secure facilities and some retail settings to improve security during transactions.

Challenge: Like fingerprint scanning, palm print recognition can be less effective if hands are dirty or wet. Plus, it requires larger scanners that may not be practical for all settings.

6. Vein Recognition

Vein recognition identifies you by mapping the unique patterns of veins in your hand or finger. This method is very secure because vein patterns are hard to replicate and can only be captured by a living person.

Use Case: Vein recognition is often used in banking ATMs and secure access points where high security is necessary.

Challenge: The technology needs specialized sensors that are not widely available, limiting its use in everyday payment situations.

[Also Read: The Role of Artificial Intelligence in FinTech: Revolutionizing Customer Experience and Risk Management]

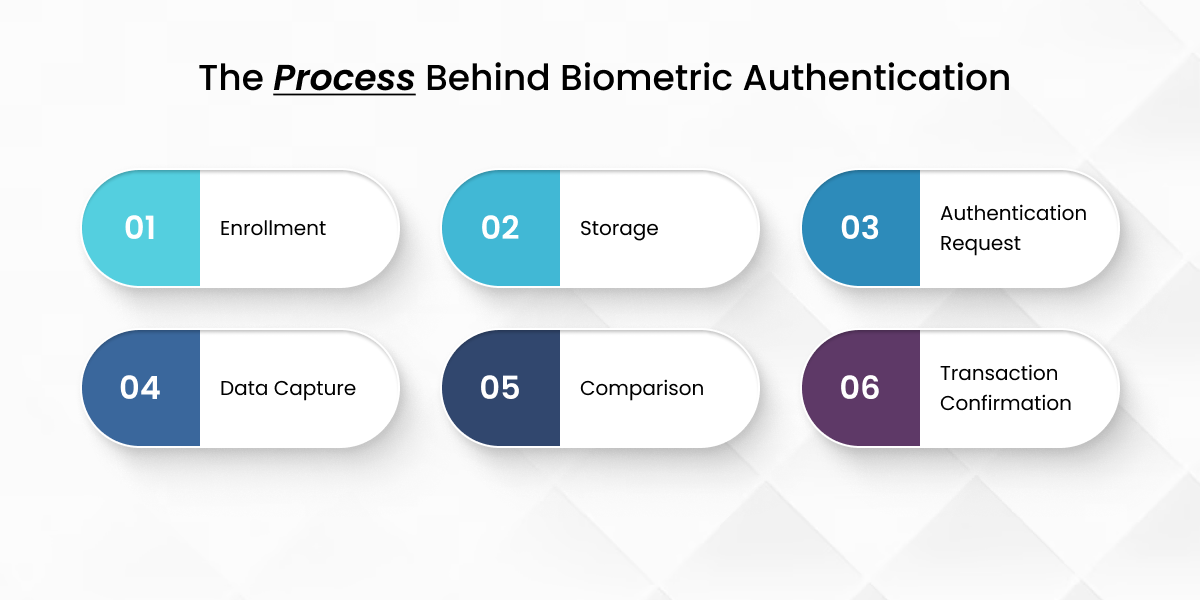

How Do Biometric Systems Work?

Biometric systems use unique physical traits to confirm a person’s identity. When you sign up for a biometric system, your biometric data, like your fingerprint or facial features, is securely stored and encrypted to protect your privacy.

This data is then turned into a template, which is a simplified version of your unique characteristics. During transactions, the system compares the live biometric data captured at the moment with the stored template to verify your identity.

Here’s a quick breakdown of how the biometric payment system works:

1. Enrollment

First, you need to register by providing your biometric data. This could mean scanning your fingerprint or taking a picture of your face. The data is processed and converted into a secure template, which is stored in the system's database.

2. Storage

Your biometric template is then encrypted and stored safely in the system. This means that even if someone tries to hack into the database, they won’t be able to access your actual biometric data.

3. Authentication Request

When you’re ready to make a payment, you start the authentication process by using your biometric data again. For example, you might scan your finger or look at a camera.

4. Data Capture

The system captures your live biometric data right then and processes this information to pick out key features that are unique to you.

5. Comparison

The system compares the live data it just captured with the stored template in its database. If it finds a match, it confirms your identity.

6. Transaction Confirmation

Once your identity is verified, the payment is quickly processed, allowing you to complete your transaction without any delays.

[Also Read: Exploring the Impact of Fintech in Financial Services: Disruption and Opportunities]

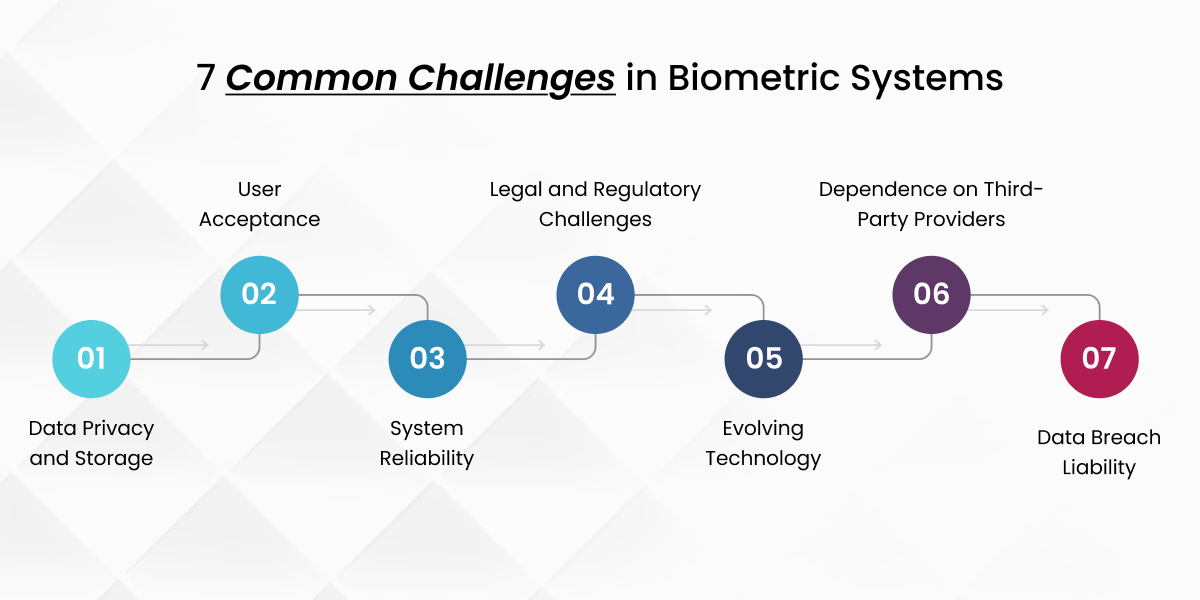

Challenges in Biometric Systems

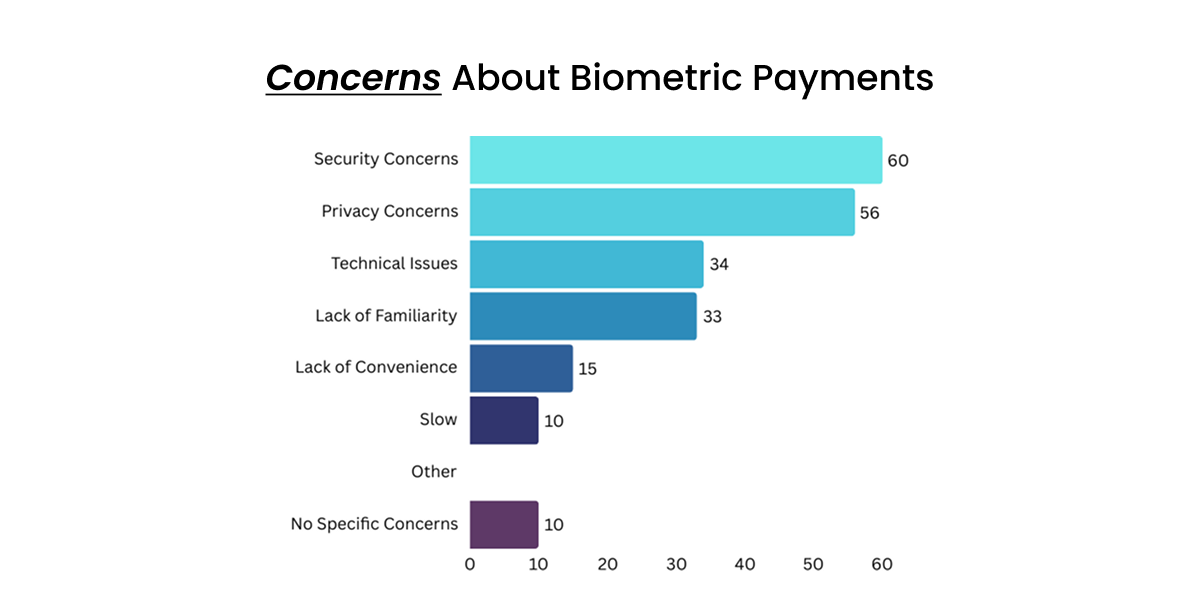

While biometric payments provide many benefits for businesses, they also present challenges and concerns that require careful attention. Below are the common challenges:

1. Data Privacy and Storage

One of the biggest concerns with biometric systems is how personal data is collected, stored, and used. Since biometric data is unique to each person, if it gets hacked or misused, there’s no way to change it like you would a password. This raises serious questions about privacy and security.

2. User Acceptance

Not everyone is okay with using biometrics for payments. Some people worry about how their data will be used or feel uncomfortable with the idea of their physical traits being stored digitally. Building trust and educating users about the benefits is crucial for wider adoption.

3. System Reliability

Biometric systems aren’t perfect and can sometimes fail to recognize users correctly. Factors like lighting conditions for facial recognition or dirty fingers for fingerprint scanners can lead to errors. This can frustrate users and make them question the security of biometric payments.

4. Legal and Regulatory Challenges

With biometric technology growing, the laws around it are also growing. Different countries have different regulations about how biometric data should be handled, creating confusion for businesses trying to comply.

5. Evolving Technology

Technology is always changing, and that includes biometrics as well. While new advancements can improve systems, they can also introduce new risks. For instance, deepfake technology acts as a challenge for voice and facial recognition systems, making it harder to maintain authenticity.

6. Dependence on Third-Party Providers

Many biometric systems depend on third-party providers for software and hardware solutions. If those providers do not prioritize security or if they experience a breach, this dependence can create vulnerabilities. Businesses need to choose their partners wisely to protect user data.

7. Data Breach Liability

If a biometric system suffers a data breach, the consequences can be severe. Unlike passwords that can be reset, stolen biometric data remains tied to an individual forever. This raises questions about who is responsible for protecting that data and what happens if it gets compromised.

How Can Protonshub Technologies Help You?

Want to include a biometric fingerprint payment system or other payment systems in your business? We’ve got your back.

Our team specializes in creating user-friendly solutions that make payments safer and easier for everyone. No matter if you want to set up a simple biometric payment option or a complete system, we’re here to help you every step of the way.

We build secure apps that keep your customers' data safe while also keeping the payment process smooth. With our expertise, you can take advantage of the latest technology to enhance your services and make transactions quick and reliable for all your customers.

Frequently Asked Questions

Ekta Singh

"Senior Content Writer"

Ekta Singh is a rookie food experimentalist and k-drama fan with 4+ years of experience in writing. Bridging gaps between companies and customers through conversion-driven content is her forte. She believes in writing stories for a living and living life for exploring places.

Newsletter

Subscribe to Weekly - Get five biggest headlines in blockchain straight to your inbox

Trending Blog

Jul 03, 2024

How Blockchain Technology Can Revolutionize the Fintech Industry

Feb 16, 2024

AI in E-commerce: 8 Ways It’s Transforming the Business

Feb 13, 2024

Top Emerging Web Design Trends for 2024 and Beyond [Updated]

Contact Us

Contact Us

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.png)